The white house finally releases a regulatory framework for crypto assets; plus our weekly BTC and ETH analysis

Technical Tuesdays

- White House Releases Regulatory Framework for Digital Assets

- Bitcoin/USD – BTC Back at Bottom of Range

- Ethereum/USD – ETH Loses Merge Momentum

White House Releases Regulatory Framework for Digital Assets

On September 16th, President Biden’s administration released a framework pushing for more regulation on digital assets such as cryptocurrencies following an executive order released in March, in which President Joe Biden called on federal agencies to examine the risks and benefits of cryptocurrencies. The framework is broken down into 7 sections which include “Protecting Consumers, Investors, and Businesses”, “Promoting Access to Safe, Affordable Financial Services”, “Fostering Financial Stability”, “Advancing Responsible Innovation”, “Reinforcing Our Global Financial Leadership and Competitiveness”, “Fighting Illicit Finance”, and “Exploring a U.S. Central Bank Digital Currency (CBDC)”. In accordance with the research provided, the White House intends to empower the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) to “aggressively pursue investigations” in the digital asset space. The last section of the fact sheet is dedicated to the U.S. CBDC. It states that the administration has already developed policy objectives for a U.S. CBDC system, but “further research” is needed on the possible technological foundation of that system. Agencies that were chosen for the research and possible development of a CBDC include the Federal Reserve, the National Economic Council, the National Security Council, the Office of Science and Technology Policy, and the Treasury Department.

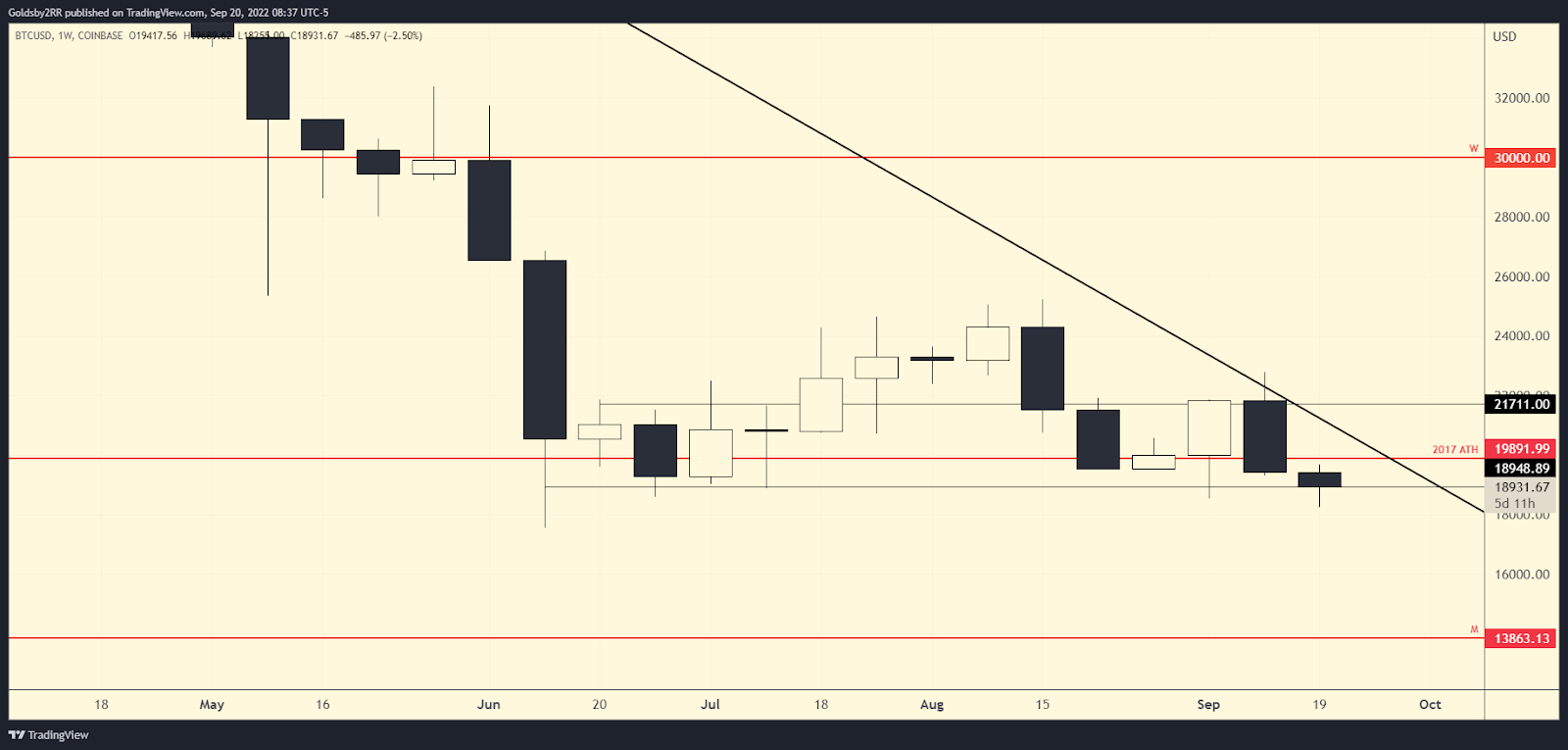

Bitcoin/USD – BTC Back at Bottom of Range

BTC Daily Chart

https://www.tradingview.com/x/fHlDgdB1/

BTC Weekly Chart

https://www.tradingview.com/x/6w3uEIZS/

At the time of writing, bitcoin is priced at $18.8k and has found its way back to the bottom of the range established in June of this year. If price closes below this range the next HTF area of support on the monthly time frame is at $13.8k and there is also a weekly area of support located around the $16k area. I would expect one of these areas to act as support should we lose the range support located at 18.9k on a daily closing basis.

Bitcoin Bull Scenario

Bitcoin maintains the range support level at $18.9k and reclaims at least the $20k handle.

Bitcoin Bear Scenario

Bitcoin closes below the $18.9k range support on a daily closing basis and either $16k or $14k is the next area to watch as support.

Ethereum/USD – ETH Loses Merge Momentum

ETH Daily Chart

https://www.tradingview.com/x/oeosqlTf/

ETH Weekly Chart

https://www.tradingview.com/x/qgFFM6Fc/

At the time of writing, Ethereum is trading at $1346, and seems to have lost the momentum it once had from the upcoming merge event which has now passed. The first level of resistance right above where price is currently located is the prior 2017 ATH and the next level just above that is the weekly $1.8k resistance. Just below where price is currently at is a level of daily support around $1.2k and another level near the $1k handle. Should price fall through both of these levels there is a more HTF level of support located around the $700 area.

Ethereum Bull Scenario

Ethereum reclaims the prior 2017 ATH level and/or the weekly $1.8k level.

Ethereum Bear Scenario

Ethereum does not reclaim the 2017 ATH level and the next few areas of support from highest to lowest are $1.2k, $1k, and the HTF monthly area located near $700.