Bitcoin Dominance and Total Crypto Market Cap can give you an edge if you understand how to use these charts in combination

Bitcoin Dominance refers to the ratio between the market capitalization of BTC to the total market cap of the crypto market. When we compare this ratio to the trend of Bitcoin itself, we can find opportunities in the current market environment.

To understand what Bitcoin Dominance is, traders also need to understand what market capitalization is — and why it’s important.

Market capitalization (“market cap”) or MCAP is the total value of all the coins that have so far been mined or minted. The market cap is calculated by multiplying the number of coins in circulation by the current market price of a single coin.

Why Bitcoin Dominance Is Important

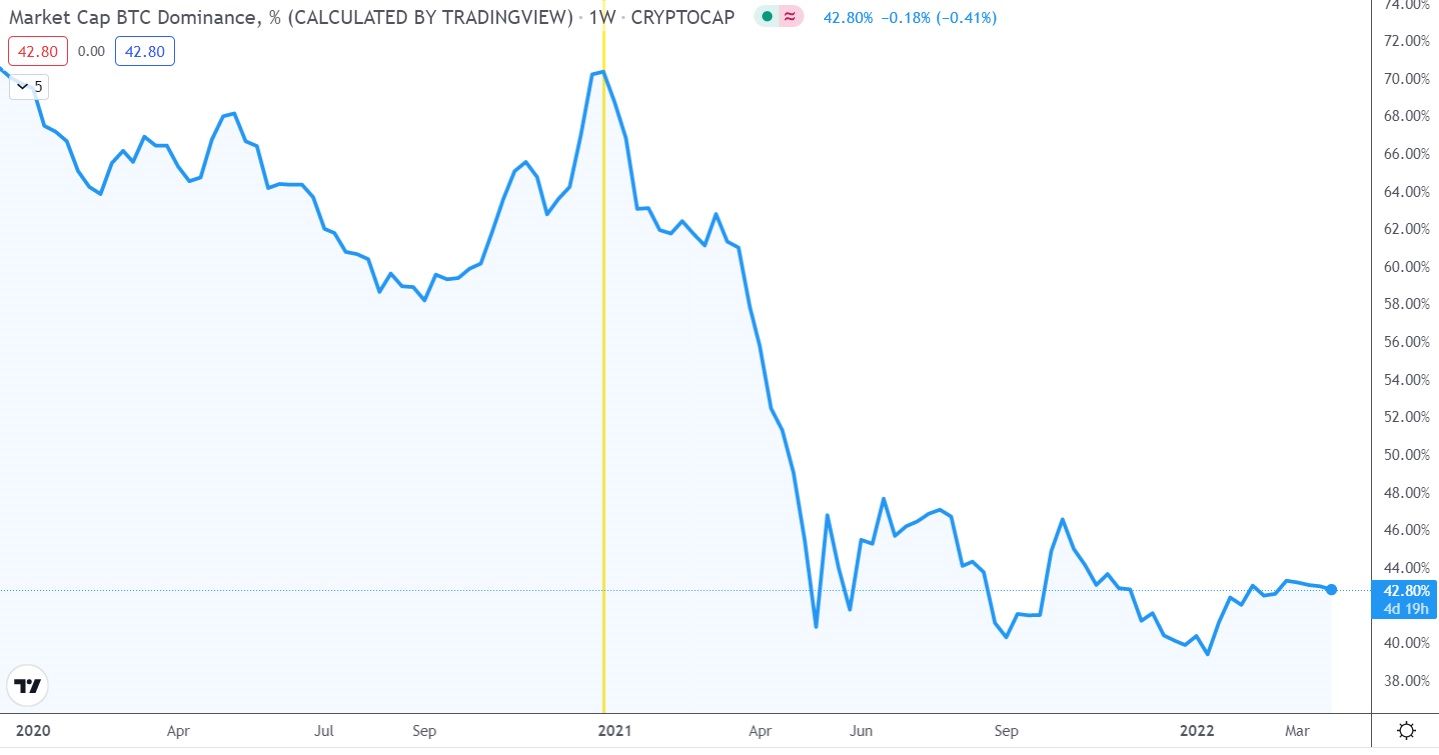

Bitcoin Dominance measures the Bitcoin market cap as a percentage of the total crypto market cap. If you look at the chart for last year, the share of BTC in the total crypto MCAP declined from 73% at the start of 2021 to recent lows near the 39% level.

If you were getting exposure to new chains and DeFi during this time, you were in position to do very good last year as the total crypto MCAP was growing. New money was pouring into crypto while also moving from Bitcoin into Altcoins.

If Bitcoin Dominance grows at a time when the total crypto market cap declines, then Altcoins would suffer the double whammy. In this scenario, investors would be moving funds out of crypto markets, and the ones who stay in are moving to Bitcoin as their safe haven.

How To Trade Bitcoin Dominance

There are multiple factors to consider when attempting to trade Bitcoin dominance. First, understand your time-frame and what type of trader you are as this works better on the higher time frames – medium term to long term.

Traders should consider this is not a price chart and should not expect similar action. For example, Bitcoin’s dominance used to be over 90% when few altcoins were available. It ranged from about 60% to 70% for 18 months prior to the big dip beginning in January 2021. Enthusiasts note that Bitcoin’s dominance is unexpected to hit those extreme highs ever again due to the prevalence of Altcoins in today’s market. In fact, Bitcoin Dominance is much more likely to hit new lows than new highs as the crypto markets mature and gain mainstream popularity.

Traders should note when Bitcoin Dominance is trending toward local highs as that could mark a good point where we may see resistance and even a reversal back down. Also keep an eye on new lows and how the Altcoin market is reacting as a result.

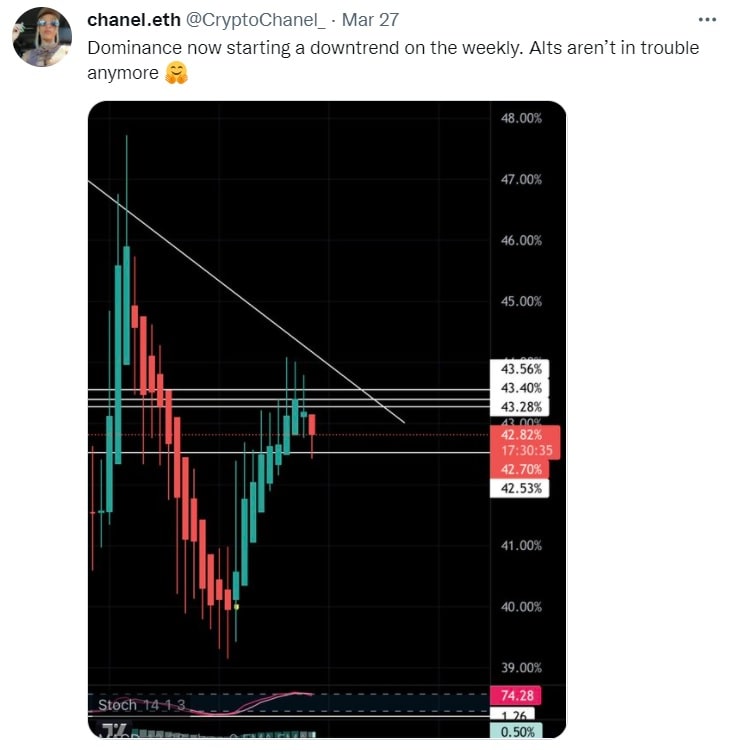

One trader who goes by Crypto Chanel on Twitter noted a recent downtrend and pointed this out to her followers as many top Altcoins started to look good again.

She then began looking for more coins that hadn’t reacted yet and even asked her followers to give her some coins to chart. Most of them were hitting lows or had been consolidating – meaning they were likely at a good entry.

Whether you swing trade or like to be more of a long-term trader, you can use the Bitcoin Dominance and Total Crypto MCAP charts to give you that edge on when to enter and exit. Combine this with good fundamental analysis and knowing project roadmaps, and you can be way ahead of the game.

The most important thing to remember is to take profits when you’re ahead and have a plan for both bullish and bearish scenarios. The market is not there to GIVE you money, and that’s why we call it TAKING profits.