We take a step back to look at the $DXY US Dollar Index and its relationship to crypto markets

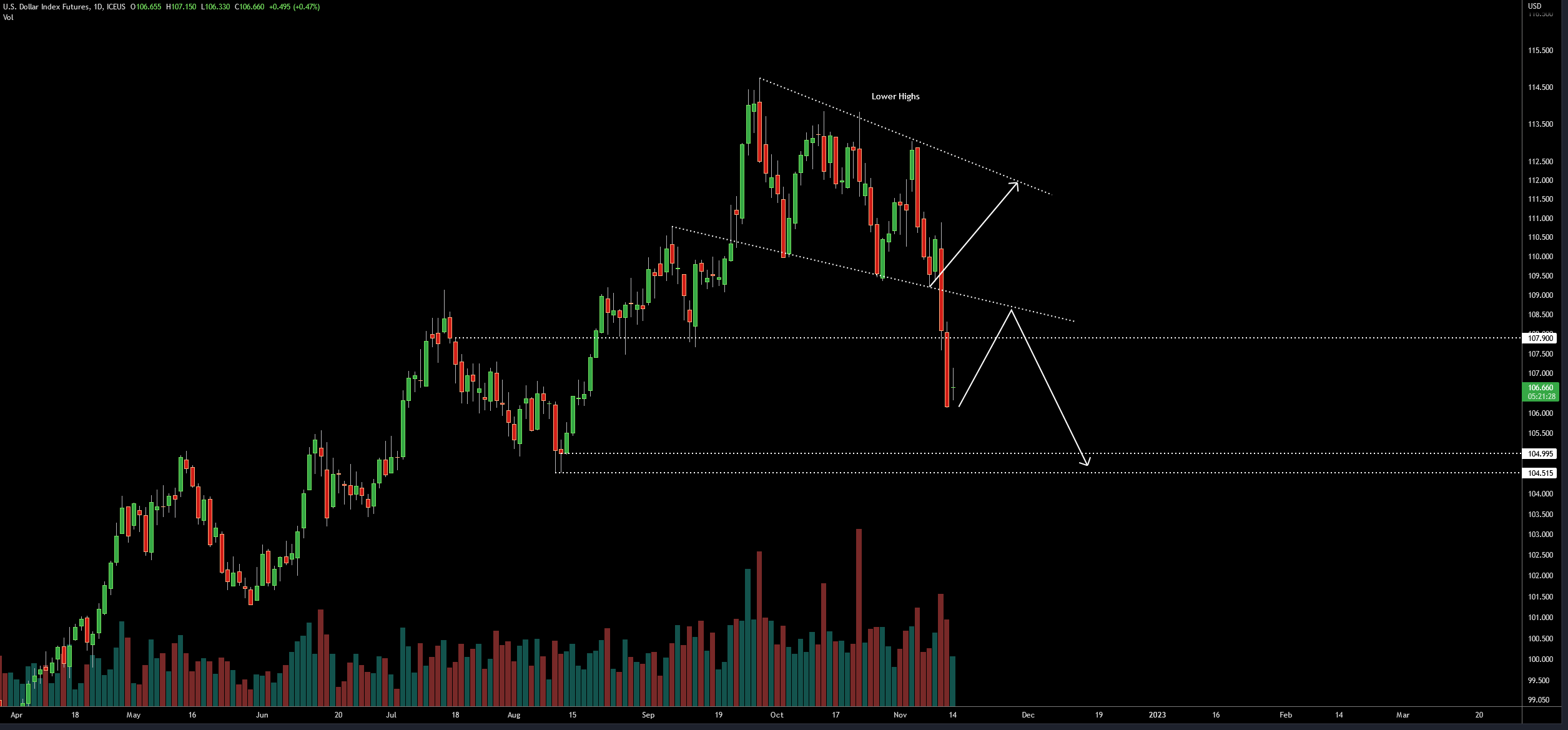

US Dollar Index $DXY

$DXY set up one of the most legendary bear traps of the year last week. After bouncing from a clear structure that was forming it promptly nuked right through it on the CPI print.

Anyone who has been paying attention to markets for some time knows the relationship between interest rates, the dollar, and crypto. Macro structure does seem to be changing on it, but weekly momentum has been completely reset.

Probably no major moves on it until the next FOMC. In essence, a weaker dollar is good for markets. Not enough information to say top yet, but the dollar bulls were getting crowded and this was a needed wipe.

Bitcoin $BTC

Bitcoin had a rough week in the shadow of the FTX saga, which is far from over. Not only did people lose all of their money to trade, they lost all their money to buy spot holdings.

FTX/Alameda have been removed from the market as a market maker and as such, this has a chance to just keep melting. Tradition for bear markets in Bitcoin is ~80% and we’re approaching that level soon. The range break this week after weeks of sideways reminds me of the 2018 nuke to our terminal bear market bottom.

Snowden has publicly said he’s looking to start scaling in this week, and the last time he signaled the same was the 2020 covid lows. Stories all over social media about friends making fun of crypto and telling others they knew it was a scam.

Signs of a bottom are forming, but there’s no rush to buy yet. Personally would not be leveraging here. But it’s probably approaching time to start DCA from a sheer “market trauma bottom” standpoint.

We will have multiple weeks to examine the candles and evaluate. Of course, this is not financial advice.